It’s now September and that means the year is almost over. The kids are back in school, cottage long weekends are long gone, and Q4 approaches. It feels like prime time to reflect on what has transpired so far in 2024 before we say hello to 2025.

Thankfully, The BetaKit Podcast dropped two episodes featuring 2024 predictions and big tech questions, offering an easy lens through which to view the year and—most importantly—evaluate my colleagues’ evaluations.

AI dominated both conversations. As podcast co-host Rob Kenedi correctly predicted, companies are spending significant time and resources to figure out use cases for a technology that hallucinates. Big Tech has spent more than $150 billion USD in CapEx over the last 12 months, and AI firms continue to secure big rounds in an otherwise chilly market, with Radical Ventures’ $800 million USD fund, Cohere’s $500 million USD round, and OpenAI’s reported $6.5 billion USD ongoing fundraising being the most recent examples.

But what about return on investment? One of BetaKit editor-in-chief Douglas Soltys’ big questions for 2024 was whether AI would become “de facto or verboten.” Apple and Google both embracing AI in their major consumer smartphone launches would point to the former, but Sequoia’s search for revenue growth has grown into a $600 billion question. Nvidia can’t remain the only company making money on AI.

The podcast also pondered whether 2024 would see a return to tech IPOs. This year has seen almost as many publicly traded companies return private as we saw tech IPOs during the boom times of 2021. Investors have told me that founders don’t like dealing with the burdens and scrutiny of being publicly traded, but a recent report from The Globe and Mail indicates more structural issues in nurturing Canadian companies to the public markets.

Almost nine months in, it all seems to reflect what BDC called “uncertain market conditions” in our story below. What’s your prediction for how the year will close out? My inbox is open.

Bianca Bharti

Newsletter editor

The rumours are true—Shakepay lets you earn bitcoin just by shaking your phone.

And there’s much more. Buy bitcoin for just $1 and earn bitcoin in ways that are actually fun: keep up your daily shaking streak, shop with the Shakepay Card, and get a bitcoin bonus on payday — we call that getting #shakepaid.

Shakepay’s easy, fast, and secure. It’s licensed as a Money Service Business by FINTRAC and registered as a Restricted Dealer in all Canadian provinces and territories.

BTW – now through mid-October, spot Mike and Ella on the Inflated Tour to hear directly from Canadians on the rising cost of living. They’re in a big blue van you can’t miss 🚙

Visit shakepay.com and join over 1 million shakers. The goal’s ambitious: bring bitcoin and financial freedom to every Canadian.

Shakepay’s growing. Want to join the team or have great friends? See open roles here.

TOP STORIES OF THE WEEK

BDC appoints Geneviève Bouthillier as head of BDC Capital

This announcement comes just over three months after BetaKit reported the departure of Jérôme Nycz as EVP and head of BDC Capital after more than a decade at the helm. Nycz left the organization in July. In the wake of his sudden and unexpected retirement, BDC CFO Christian Settano had assumed Nycz’s role. Bouthillier will take the reins going forward.

Bouthillier is assuming leadership of BDC Capital at a particularly tough time for Canada’s VC market, and by extension, the country’s tech startups. BDC’s latest annual report reflects this: the Crown corporation marked down the value of its VC portfolio by $220 million, noting its fiscal 2024 results were “below plan,” partially due to “uncertain market conditions.”

Academics, nonprofits caught in middle of data consent fight as AI companies push for access to copyrighted works

As major artificial intelligence companies like OpenAI, Cohere, and Anthropic seek more copyrighted works to use to train their models, it is academics, nonprofits, and early-stage AI startups who are struggling the most to find material they are allowed to use, experts told BetaKit.

Restrictions are quickly being added or enforced to a significant chunk of the data that companies are using to train their models. OpenAI, Microsoft, Stability AI, Anthropic, Udio and Suno are facing copyright lawsuits from newspapers, authors, and some of the world’s largest record labels. And a growing number of web publishers are attempting to bar AI web crawlers from scraping their content.

“What this means for the organizations and AI developers that do respect robots.txt preferences … the quality of models they can produce will be worse,” said Shayne Longpre, lead of the Data Provenance Initiative.

Union representing Paper tutors threatens legal action following mass layoff

Earlier this year, COPE local 131 in Ontario and SEPB-Québec local 574 were granted accreditation to represent Paper tutors in collective bargaining following a secret vote. Both unions were still in the process of preparing first negotiations when Paper laid off all the tutors, SEPB-Québec told BetaKit in an email.

“SEPB-Québec will take all legal action they deem necessary to ensure that employees are treated fairly,” the union said in a statement.

OMERS Ventures to be moved under new Private Capital group run by Michael Block

After OMERS Ventures managing partner and global head of ventures Damien Steel left for a portfolio company, industry observers speculated to BetaKit that the Canadian pension fund would soon roll its venture capital arm under the leadership of Michael Block. Almost one year to the day, that prediction has come true.

On September 10, OMERS announced the promotion of Block, previously senior managing director at OMERS Private Equity, to head of its newly-created Private Capital group. In this new role, Block will oversee Ventures, Growth, Green Tech, Life Sciences, European and Asia-Pacific private equity, as well as the firm’s global funds strategy.

Saskatchewan tech sector employment doubled over four-year period: report

According to data shared Tuesday at a press conference held by the government innovation agency in Saskatoon, employment in the province’s tech sector has grown nearly 109 percent to 5,489 workers from 2019 to 2023. Between 2016 and 2023 the tech sector accounted for 10 percent of all new jobs created in the province, more than mining and manufacturing despite those sectors being larger.

The Saskatchewan tech sector has added 715 jobs on average annually since 2016, which would put the province on pace to exceed its target of adding 7,893 jobs by 2030.

AI is learning fast, are we?

At St. Michael’s Hospital in Toronto, healthcare professionals will soon use AI-powered tools to identify patients at the highest risk of being admitted to the ICU.

In radiation oncology, researchers are leveraging AI to accelerate treatment planning, promising faster, more precise care.

You might think that training artificial intelligence models to solve major medical challenges would be the hardest element of these workplace initiatives. But it turns out programming humans is even harder.

20% OFF TICKETS TO ELEVATE FESTIVAL

Canada’s premiere tech & innovation event takes place from Oct 1-3, 2024 in Toronto. Elevate Festival unites world-class innovators, and industry leaders to shine a spotlight on Canada’s tech community.

Don’t miss 300+ speakers across 9 content tracks, opportunities for women in tech and startups, plus enhanced networking and lead generation. Don’t miss out on our food trucks and exclusive after hours socials! Use code: ELEVATEFESTBETAKIT at checkout.

Funding, Acquisitions, and Layoffs

SFO – Landbase – $12.5M USD

VAN – DIGITAL invests $53M CAD across 11 projects

VAN – Teal acquired by Mercury

VAN – Catalera BioSolutions – $8.8M CAD

VAN – Spare – $42M

TOR – Ecomtent – $1.15M CAD

TOR/PHL – Radiant Biotherapeutics – $35M USD

MTL – Luge Capital – $96M CAD

OTT – Kahi – $2.3M CAD

HFX – Iris Booth acquired by Rundle Partners

The BetaKit Podcast

Pablo Srugo wanted to be “insanely rich.” It killed his startup.

“This was mine. This was done. I was going to be the next Steve Jobs, I was going to be rich—everything was happening. And now they took it away.”

As the young co-founder of Ottawa-based Gymtrack, Pablo Srugo had one goal: “become insanely rich.” Now a partner at Mistral VC, he joins the podcast to share what went wrong and caution founders against becoming their own worst hypebeast.

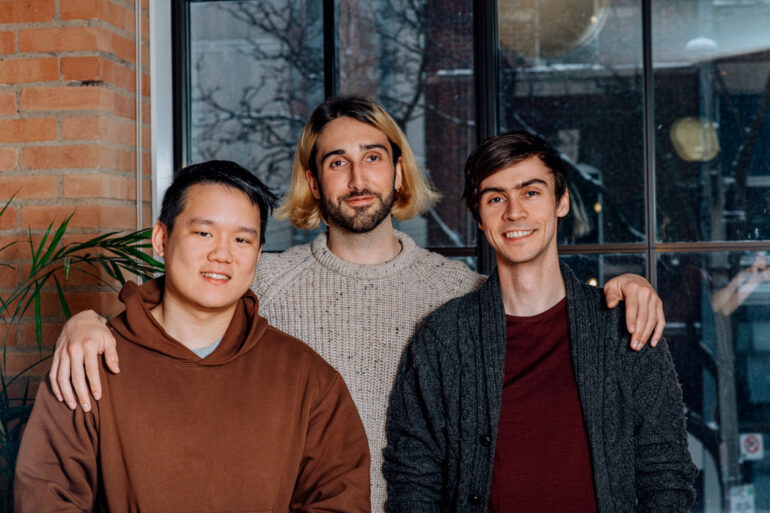

Feature image courtesy Cohere.