Agriculture innovation has been heralded as one possible way to drive the Canadian economy in a post-COVID world and investors are taking notice. According to Pitchbook, over $1.5 billion USD ($1.9 billion CAD) went into AgTech startups in 2021 (up from $1.4 billion USD / $1.8 billion CAD in 2020), with trends continuing through 2022.

“We can’t separate the health of our food systems and the impact of climate change.”

– Ka-Hay Law, TELUS Pollinator Fund for Good

Yet agricultural innovation is not just about capital injections. The true measure of success will be the outcome: sustainable food systems that both feed people in a healthy way and drive economic growth. Doing that requires the right investments and collaborations to help farmers and other food producers maximize yields while also handling new dynamics—from climate change to pests, frosts, droughts, and other environmental conditions that come with it.

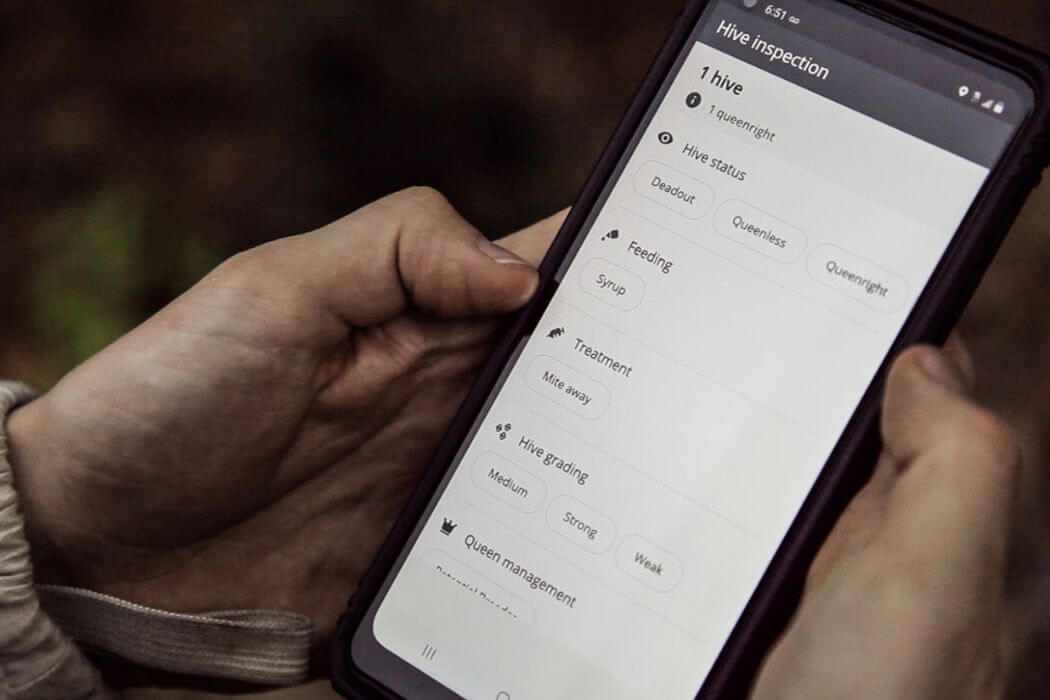

Speaking with BetaKit, three AgTech innovators—Ran Goel, founder of Fresh City Farms in Toronto, Marc-Andre Roberge, co-founder and CEO of Nectar Technologies in Montréal, and Vancouver-based Ka-Hay Law, Investment Director at the TELUS Pollinator Fund for Good—discussed how technology is driving food sustainability and why it’s so critical to get AgTech right.

Better food systems are sustainable food systems

A common understanding of “sustainable” food systems is using environmentally friendly practices or growing organic food, but Goel and Roberge said the concept runs much deeper. It’s not just about any individual food type or practice, but the whole ecosystem around food production.

“It has to start with providing all people—emphasis on all—with enough food and nutrients to nourish themselves,” said Goel. “That is the foundation. Then the question becomes: how do we do that in a way that can essentially carry on indefinitely into the future?”

Roberge added that he feels sustainable food systems are more about a holistic environmental approach rather than focusing on single indicators like food shelf-life or specific organic farming practices.

“While I understand that feeding eight billion people on our planet (and soon 10 billion by 2050) is an incredibly complex challenge, we can’t disregard the enormous impact that farming has on the environment,” said Roberge. “While yield is an important output, it cannot be siloed from the other negative outputs that conventional farming practices have on climate change, water pollution, or plummeting wild insect populations.”

For Law, technology has a significant role to play in building sustainable food systems. In particular, she feels the current global food ecosystem is very opaque and difficult to understand for the typical consumer. She said technology has the opportunity to bring transparency into the system, letting people know where their food actually comes from. Informed consumers can begin to choose more sustainable sources of food because they’ll actually know what’s sustainable and what’s not. For producers, better insight into how they are managing food systems could spur on sustainable food production practices.

“Technology plays such an important role in improving transparency of our food systems,” Law added.

How VCs find the right AgTech investment

Investing in the “right” technologies to build sustainable food systems can be a challenge, with so many actors in the space and not all truly committed to making a positive impact. Law noted some indications as to whether a company might be a good investment from both a sustainability and financial perspective.

The first things to look for are food access and food quality. For Law, access is impacted in a variety of ways: availability of different food varieties, how far someone lives from a food source (like a grocery store), and the costs associated with buying food (which can be impacted by distance as well). If one of those elements is significantly off, then food access is compromised. As a result, investors in the sustainable agriculture world need to think about how their portfolio companies tackle all three factors while also considering food quality and nutrient density.

Second comes value chain sustainability and food waste management. Law said it’s critical for organizations in this space to understand how they consume water and produce carbon in their operations, from growing to distribution. She also noted that sustainable practices include tackling climate change, which is already threatening traditional farm yields and outcomes. This is not only good business, but will also be required as future legal and regulatory changes propel sustainable practices forward.

“We can’t separate the health of our food systems and the impact of climate change,” Law added.

Investing in the “right” technologies to build sustainable food systems can be a challenge, with so many actors in the space and not all truly committed to making a positive impact.

Next comes both the financial viability of the company and measuring the impact they hope to make. The former requires a plan toward profitability that has impact baked into the core business model – as the business grows, so does the impact. For the latter, Law looks for concrete evidence that the company’s innovations are making a change. This could come in many forms—for example, lowering greenhouse gas emissions, food costs, or water use—but it is critical for each company to figure out their own impact measurements based on mission and product roadmap.

“If we can get measurability we can get a lot more strategic in terms of active management of the business to ensure results are achieved,” said Law.

That active management isn’t just about the money. Goel noted that the TELUS Pollinator Fund has not only been an active board member but also a key contributor to how Fresh City Farms thought about acquisitions for growth, particularly its purchase of Mama Earth and its subsequent integration into the Fresh City Farms organization. Goel also said the Pollinator team helped them develop their impact measurements and plan a promotional campaign for the company.

This kind of partnership follows a larger trend in venture capital investment, both from traditional VCs and impact investors: as the money itself becomes commoditized, the most successful investors are then those who can offer true value-adds to their portfolios.

For the Pollinator Fund, capital support is as important as providing access to the broader TELUS network and resources in healthcare, agriculture, and telecommunications, along with access to talented people to serve as mentors or advisors to aid in the growth of portfolio companies.

“We don’t want to just be another cheque,” Law said.

Photos courtesy of Fresh City Farms and Nectar Technologies.