Until now, Derrick Fung is more likely known as the CEO of Tunezy, a platform that allows musicians to market experiences — such as meet and greets and online chats — to their fans. After the Toronto-based company was acquired by SFX Entertainment, which owns festival brands like Tomorrowland and Electric Zoo, Fung made Forbes’ 2014 Top 30 Under 30 list for music, and Fung moved the Tunezy team from Toronto to New York while he continued leading Tunezy as CEO.

But as is the case for many founders, his appetite for building companies wasn’t satisfied. After SFX Entertainment’s CEO asked Fung what he thought about the future of loyalty programs for millennials and music festivals, Fung — who has a background in finance in roles like foreign exchange trading on Bay Street — thought more about the potential to disrupt what he saw as an archaic market.

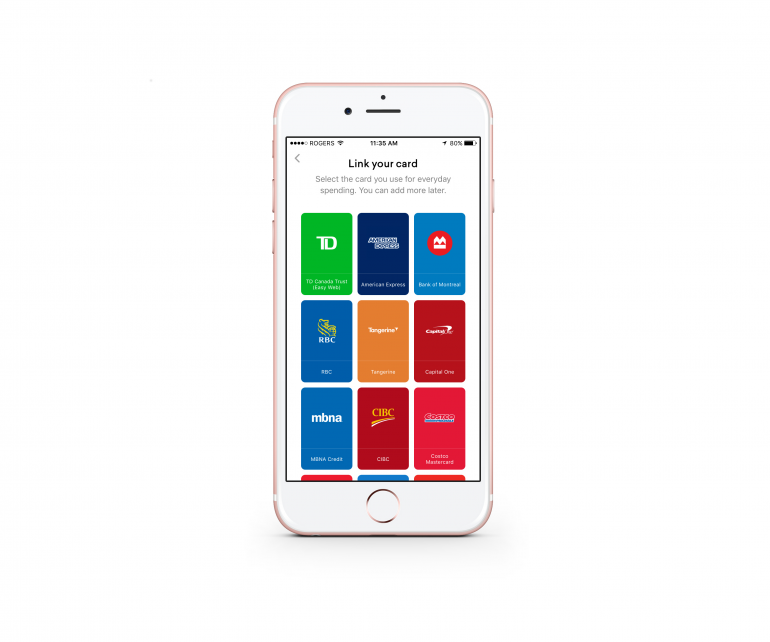

Today, Fung officially launched Drop, an iOS app that allows users to earn rewards and points on top of what current card reward programs already provide. Users link their credit or debit to the app, and every earn points for whenever they spend with Drop’s merchant partners. During beta testing, the company’s beta users collected over one million points and linked over three payment cards on average.

Though only launching today, the company has already raised $1 million CAD in funding from U.S.-based investors like ff Venture Capital, White Star Capital, and Rothenberg Ventures. HIGHLINE is the only Canadian investor.

“Part of this is the fact that it’s a big idea, and our vision is to change loyalty as it is today. If you look at some of the programs in the market today, they haven’t really evolved as tech evolved,” said Fung about how he managed to raise the money pre-launch. “You still have to bring a physical card to stores, and a lot of programs require you to swipe a card and checkout.”

“We wanted to operate in Toronto because the city is a hotbed for loyalty programs. Toronto has a bit of a loyalty mafia.”

Fung says Drop is valuable in two ways: how it appeals to a millennial market and the current state of loyalty programs in Canada, the UK, and the US. Currently, credit card interchange fees for merchants to accept credit cards at their stores are going down, which was used in the past to fund rewards programs. Drop – which uses machine learning to customize offers for consumers and learn about their changing spending habits — can make up for those points lost from declining interchange fees.

The company is partnered with brands like Wealthsimple, Foodora, Chef’s Plate, Urbery, Thirstie, Carnivore Club, and FanXchange, brands that Fung said appeals more to Drop’s target market. “With some of the programs out there in market, a lot of brands that are promoted are not exactly the brands that young people shop at,” said Fung, pointing out the fact that most loyalty programs don’t allow users to redeem through their phone even though mobile accounts for 30 percent of all U.S. ecommerce. “Young people like shopping online, ordering things on demand, and many don’t want to visit brick and mortar stores.”

While the Tunezy team worked out of New York, Fung made the decision to come back to Toronto to build Drop because of its strong FinTech ecosystem. After Mike Serbinis raised a $25 million Series A for LEAGUE, the concept of a ‘justice league for FinTech’ was introduced as Canadian startups — especially in Toronto — support each other with partnerships. At the same time, existing financial institutions are constantly partnering with startups in their quest to remain nimble.

Fung had some team members from New York and San Francisco — some of them ex-Amazon, Facebook, and Eventbrite — make the move to Toronto. “We wanted to operate in Toronto because the city is a hotbed for loyalty programs. If you look at the largest loyalty companies out there, in Toronto we have Aimia which owns Aeroplan and Nectar in the UK. We have Loyalty One, Scene, and Points.com. So in my opinion, Toronto has a bit of a loyalty mafia,” said Fung. “I think a big part of it also is operating in Canada and selling to the U.S. It has appeal both for where the dollar is at, and we can leverage government support through SR&ED.”

The app is currently available across Canada, and Fung said that he has “grandiose” plans to take over the loyalty market in North America as he sets his sights on a U.S. launch in 2016. “In the U.S., the concept of air miles doesn’t even exist. One in three Canadians, or 10 million, are part of air miles. In the UK, you have half the population that’s part of Nectar, but in the U.S. there’s not one program that spans the country,” said Fung.