2015 was a good year for Vantage. Following a $1.1 million seed round the year prior, the Toronto-based ecommerce analytics startup took major steps in 2015, analyzing over $2 billion in transactions, and adding support for major platform players like Magento.

But this past January, Vantage underwent a significant change to its business. “The company has changed in order to actually be profitable,” Aran Hamilton, Vantage’s President and co-founder, told BetaKit.

“The company has changed in order to actually be profitable.”

– Aran Hamilton, Vantage

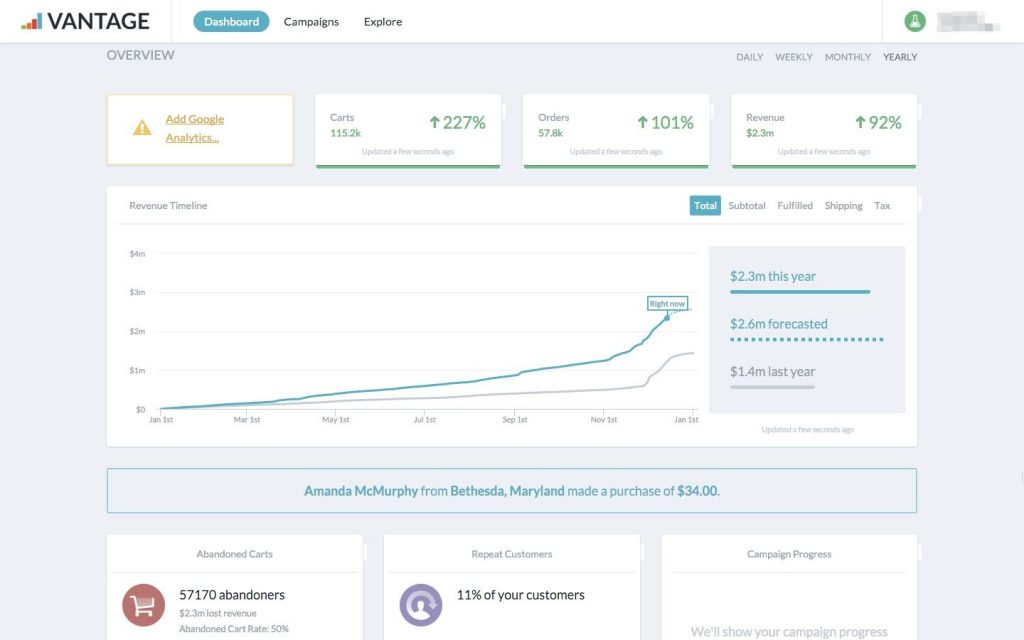

Vantage originated with the intention of being the best analytics dashboard for all major ecommerce platforms: Shopify, Magento, BigCommerce, etc. The company’s early growth was fuelled by customers referred to them by those platform giants. “We’re a better dashboard than any of them on their own, so they send us their big customers,” Hamilton said.

While those big customers lapped up the analytics and insights provided by Vantage, amongst SMBs, the company’s dashboard proved “harder to monetize than we would have liked.” So Vantage’s core team set out on a listening campaign to learn more about their target customer.

“We started asking what these SMBs needed in their day, and what their day felt like to them,” Hamilton said. “We looked at what we were giving them in terms of analysis – and it was really good insight into what was happening in their store – but now it’s a ‘so what? What do I do about the challenges you’re pointing out?'”

Vantage realized that for its target customer, understanding how things are performing doesn’t really matter unless you know what to do about it, and can execute. But limited time, resources, and expertise can prove significant hurdles for online retailers. Hamilton told BetaKit that most stores on the major ecommerce platforms don’t make enough money to cover their monthly fees, while over half of online retailers will fail in their first year.

“People start these things thinking that they just have to build a store and it’s going to naturally grow and take care of itself,” Hamilton said. “It turns out there’s an awful lot more to running an online business than just the store itself. They didn’t realize they were also going to have to be an expert in Google Analytics and social media marketing.”

So Vantage began expanding its offering into essentially a four-step program. Step One is the dashboard. Step Two is comparative analysis, leveraging Vantage’s aggregate of just under 15,000 retailers (now with $6.5 billion in transactions analyzed) to place a customer’s individual performance in perspective with comparable retailers (size, product type, geography, etc.).

Step Three is providing proactive recommendations to improve performance. “All the people just starting out want to get to 100k, all the people at 100k just want to get to 1 million, and so on,” Hamilton said. “So we can look at the characteristics of each of the levels and tell you your peak customer rate is not where it needs to be, your abandoned cart rate is not where it needs to be.”

Hamilton told BetaKit that most stores on the major ecommerce platforms don’t make enough money to cover their monthly fees; half will fail in their first year.

Hamilton told the story of one customer that had closed its year out at $2.5 million in revenue, up one million from the year prior. When Hamilton called to check in, “you could almost hear the champagne corks going off behind her.” But the conversation faltered when Hamilton asked about company’s repeat customer rate, which was well below the aggregate for companies of that size. Vantage had suggested Facebook ad retargeting to drive more repeat sales, but the customer demurred, stating they had tried them before but found them too complicated.

So Vantage added a Fourth Step, what it calls the Vantage Stack, a bundle of Facebook and Instagram-targeted marketing campaigns designed to drive growth for its customers.

“It turns out that if you don’t do the last one, it’s not that useful,” Hamilton said. “Because you’re giving people insight about what’s going on in their store, but if they don’t know how to change it, or the time to change it, it won’t get changed.”

The results to date have been dramatic, with Vantage on average driving a 10x return on ad spend for its customers when most Facebook ads struggle to break even.

While Vantage is helping SMBs that don’t have the internal capabilities to get their message out online, the company has also seen great performance with more savvy businesses that have already primed the pump.

One such company is BodyRock, which has built a large online community for its health and fitness content. As the company expanded into selling physical products like workout gear and digital products like mean plans, CRO Dave Rossborough was looking for a partner to help target BodyRock’s 2 million Facebook and Instagram followers. Disappointed with outsourced ad agencies that tacked on costly overhead fees to low ad returns (around 2x on average), Rossborough tried Vantage. The result was an 11.2x return on ad spend.

“We saw very quickly that they could take us to scale. What we weren’t expecting was the ROI,” Rossborough said. “They’ve got this intimate knowledge of what is and is not possible on Facebook through the API that even advanced marketers like us do not know. They have this whole layer of expertise we can’t access.”

Beyond customers, Vantage’s platform partners are also happy, once again referring more leads because the company is providing capabilities they don’t have.

“Facebook, for example, they have no way to cost-effectively target small and medium-sized businesses,” Brandon Kane, Vantage’s CTO and co-founder, told BetaKit. “If you have a huge account with Facebook, they’ll put an account manager on to help, but they’re not going to do that for someone running $500 in ads per month.”

“We showed this to Google’s head of SMB for AdWords, and he said he had never seen anything like this,” Hamilton said. “His line was, ‘please promise me this is not just for Facebook’.”

“We showed this to Google’s head of SMB for AdWords. His line was, ‘please promise me this is not just for Facebook’.”

With the revised product offering came a revised business model. Vantage’s dashboard is now a free product, encouraging potential customers to drive more data into its analytics package, making them more effective with ad placements. In its place, Vantage takes a cut on ad spend through its platform; the company is now seeing 9 percent week-over-week revenue growth.

Much like the online store isn’t just sole component of an ecommerce business, Vantage also wants to move beyond ad spend, providing additional services to optimize all aspects of its customers’ business. The company is currently tracking 56 different services it could offer backed by its analytics, from product pricing to inventory and finance management (unlike its ad program, Vantage won’t build out these services solo, opting instead for strategic partners). The task seems daunting, but Hamilton seemed undeterred by the scale of the vision.

“What we’ve proven is we can take data down from the ecommerce platform and we can analyse it, benchmark it, and come up with a strategy for how you should deploy or re-deploy that intelligence,” he said. “And we’ve proven that we can be better than people would be on their own doing that.”

For now, Vantage is focused on closing its new round of funding, to hire the sales and marketing teams required to fuel its fast growth beyond referrals.

“We’re doing really well with no marketing, but if you want to be the dominant force in the market it requires sales and marketing,” Hamilton said. “Our target customer range is anywhere between 100k and $300 million in revenue, and they all need help.”

“Customers are willing to pay for growth.”