“The more it changes, the more it’s the same thing,” French critic, journalist, and novelist Jean-Baptiste Alphonse Karr said. In some ways the same can be said of Vancouver’s startup ecosystem. While preparing for an interview with Compass, (formerly Startup Genome) regarding the 2015 Global Startup Ecosystem Report, I decided to revisit their 2012 findings.

(Before comparing the Vancouver of yesterday with today: whatever city you call home and whether you’re an entrepreneur, an investor or essentially anyone in between, if you have something to share about your startup ecosystem, please take the time to complete the Startup Ecosystem Report 2015 Survey.)

Twenty cities* were ranked (actually 19, as Silicon Valley isn’t a city, it’s more of a papal state) in the survey. In 2012, Vancouver ranked 9th, which at the time elicited some collective crowing. Digging deeper into the report it’s apparent that Vancouver has a number of significant shortcomings. Compared to Silicon Valley (ranked #1 across the board) here’s a snapshot of Vancouver in 2012.

Vancouver vs. Silicon Valley (Then)

| Age | 36.7 | 34.12 |

| Gender (F/M) | 8% | 92% | 10% | 90% |

| Education (dropout vs. master + PhD) | 1 : 0.6 | 1 : 2.5 |

| Serial Entrepreneur | 50% | 56% |

| Percentage of non-technical founding teams | 9% | 16% |

| Working hours per day | 9.50 | 9.95 |

| Market (new vs. niche) | 2 : 1 | 4 : 1 |

| Motivation (product vs. impact) | 2 : 1 | 1 : 1 |

| Customer (B2B vs. B2C) | 1.6 : 1 | 2 : 1 |

Local startup examples the report highlights in 2012 include: Flickr, Summify, Unbounce, PayrollHero, MediaCore.

Other findings include:

- Vancouver startups were 8% less likely to monetize directly than SV startups.

- The funding climate for startups in Vancouver was insufficient, with startups receiving 80% less funding than startups in SV. They received 72% less in Stage 2 (Validation) and 97% in stage 4 (Scale).

- The late stage funding market basically didn’t exist for Vancouver startups.

- Vancouver startups employed less people per startup than their peers in SV.

- Compared to Silicon Valley entrepreneurs, Vancouver entrepreneurs were 59% less likely to consider customer acquisition their main challenge.

- Vancouver entrepreneurs relied 2.75x more on advertising as a revenue stream than SV entrepreneurs.

- Entrepreneurs in Vancouver were less likely to tackle ‘new’ markets and more likely to tackle ‘niche’ markets than their peers in SV.

- Vancouver entrepreneurs focused 76% more on mobile (30% vs. 17% in SV), and 21% less on web startups (58% vs. 73% in SV).

- The number of mentors per startup is almost 25% higher in Vancouver than in SV There are similar product development outsourcing levels in Vancouver as in SV.

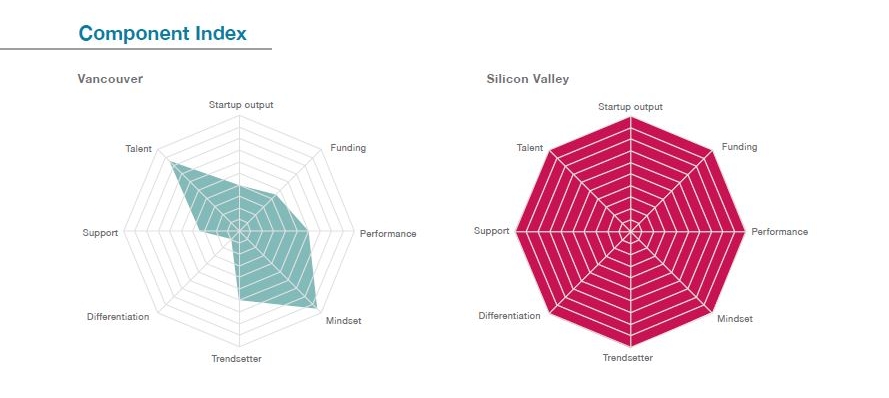

The 2012 report also measured these weighted component following indexes (Vancouver vs. Silicon Valley):

| Startup Output Index | 13th | 1st |

| Funding Index | 12th | 1st |

| Company Performance Index | 9th | 1st |

| Talent Index | 4th | 1st |

| Support Index | 14th | 1st |

| Mindset Index | 2nd | 1st |

| Trendsetter Index | 9th | 1st |

| Differentiation from SV Index | 19th | 1st |

Note: the differentiation index measures how different a startup ecosystem is to Silicon Valley, taking into account the demographics and what types of companies are started there.

Vancouver vs. Silicon Valley (Now)

Taking a broad look at Vancouver today, we clearly see the likes of HootSuite, Slack, Vision Critical, UrtheCast, Recon Instruments, BuildDirect, Traction on Demand, Unbounce, Payfirma, QuickMobile, Mobify, Bench, and relative newcomers like BattleFy, SpaceList, BitLit RosterBot, and Moj.io as examples of companies making a positive impact.

Here are some points that I shared with Compass for the 2015 report.

Strengths:

- In particular there’s a good stream of junior design and development talent in the community. The Centre for Digital Media is producing very good technical graduates; Launch Academy, the BCTIA (Centre4Growth), WaveFront, Spring.is, and BCIC/New Ventures BC is educating entrepreneurs; Emily Carr University of Art & Design and Vancouver Film School is graduating great designers; and there’s UBC, SFU, BCIT, Lighthouse Labs and Code/Core helping teach a new generation of developers.

- The community is becoming more collaborative. There’s a growing openness to sharing knowledge, experience, relationships and connections. There’s no shortage of great events and programming.

- Access to government programs like SR&ED, NRC-IRAP, Mitacs, Canadian Media Fund, and a variety of youth employment programs can significantly help with managing the cost of a startup.

- Vancouver is overall a great city to live in. The cost of living is relatively lower than SF and NYC, and quality of living is much higher. Starting a company in Vancouver isn’t that hard, but sustaining and growing one is.

- The proximity to the San Francisco & Silicon Valley (two hour direct flight) and Seattle (less than three hour drive). These communities are starting to take more notice of Vancouver. Good examples would include the increasing popularity and success of the Grow Conference, or seeing Boris Wertz join Andreessen Horowitz as a board partner.

Weaknesses:

- Securing funding at all stages is still a challenge. Overall, Vancouver investors are characterized as risk averse, and too often more willing to follow than to lead. Plus there are more entrepreneurs chasing a limited number of investors and a smaller overall pool of deployable capital, compared to the Valley, Toronto, or NYC.

- Building a B2B business can be challenging, as many corporate HQ’s are in Toronto. Plus Vancouverites can be guilty of moving at a much slower pace in being perceived as too connected with the laid back West Coast culture.

- There’s a lack of senior talent from development, design, marketing, sales and business development. Recruiting for talent outside of Vancouver is costly and challenging when competing with the likes of Google, Apple, Facebook, Microsoft, or Amazon.

- Entrepreneurs are talented but often lack direction. There isn’t a deep roster of those who have “made it” yet. Local mentors can only do so much.

- Entrepreneurs are building the wrong startups at the wrong time, and lagging behind the Valley. They are not uncovering creative ways to penetrate markets or envision new ones, they’re often thinking too small, or trying too hard to make minor changes to other people’s model instead of solving a real pain. We see entrepreneurs starting for the sake of starting and having a generally poor understanding about what it means to build a startup.

Silicon Valley North is a popular moniker, yet considering in 2012 Vancouver ranked 9th out of the 20 cities in terms of differentiation from Silicon Valley, I think collectively refraining from its use has merit.

Defining Vancouver for what it is, rather than what it’s not, acknowledging the tech community’s strengths, working even harder to fill the gaps, and appreciating that dynamic, vibrant, and thriving ecosystems don’t happen overnight is the mindset needed. Success isn’t about a ranking, success is about thinking bigger, and not just talking a good game but actually working at “getting s**t done”.

It’s anticipated that the new Startup Genome report will be issued in May. The goal of this report is all about allowing entrepreneurs and stakeholders to make more data driven decisions. You can learn more about Compass and their interest in delivering value through publishing this report here.

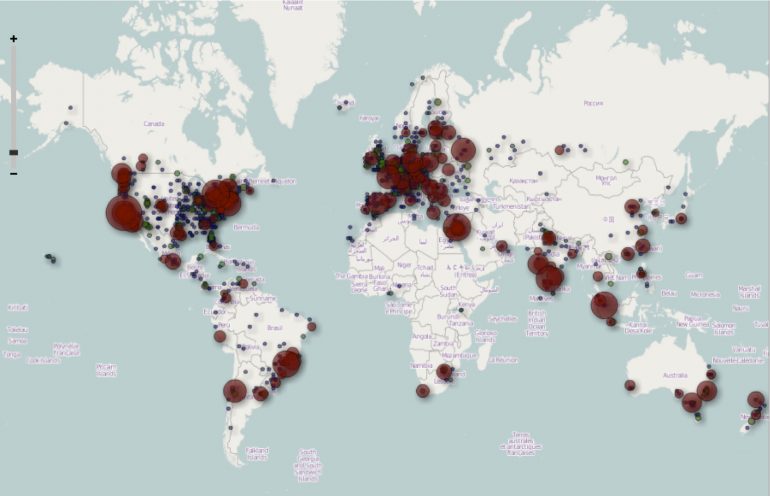

Startup Ecosystem Report overall 2012 rankings:

| 1. Silicon Valley | 2. Tel Aviv | 3. Los Angeles |

| 4. Seattle | 5. New York | 6. Boston |

| 7. London | 8. Toronto | 9. Vancouver |

| 10. Chicago | 11. Paris | 12. Sydney |

| 13. Sao Paulo | 14. Moscow | 15. Berlin |

| 16. Waterloo | 17. Singapore | 18. Melbourne |

| 19. Bangalore | 20. Santiago |