Today, CIBC announced that it is partnering with Toronto-based Borrowell to offer “one-click” online lending for customers.

The new partnership allows CIBC to leverage Borrowell’s platform and underwriting approach to adjudicate loans for existing customers online in real time, with funds typically issued the next business day directly into a client’s CIBC account.

“CIBC’s partnership with Borrowell to deliver a digital borrowing experience to clients is a first from a major Canadian bank,” said David Williamson, group head of retail and business banking at CIBC. “By leveraging innovative technology, we are taking a process that is often viewed as slow and cumbersome for clients and making it much faster and more convenient.”

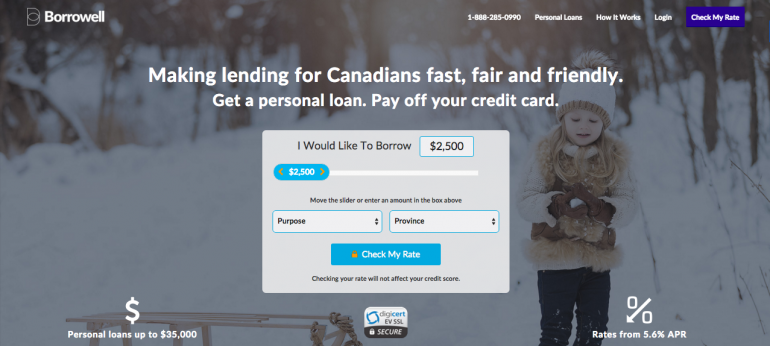

The offering is launching with loan offers to select CIBC clients, and future plans to extend the borrowing platform to a wider client base will be based on client experience feedback and input from this first phase. Currently, users can apply for loans of up to $35,000 using a simplified application process, with the ability to upload documents online for verification.

“Canadians expect technology to make experiences faster and more customer-friendly, from booking travel to online shopping,” says Andrew Graham, CEO of Borrowell. “In the past few years, we’ve seen Canadians embrace our fast, fair and friendly approach to personal loans. We’re excited to be partnering with CIBC to bring this experience to more Canadians.”