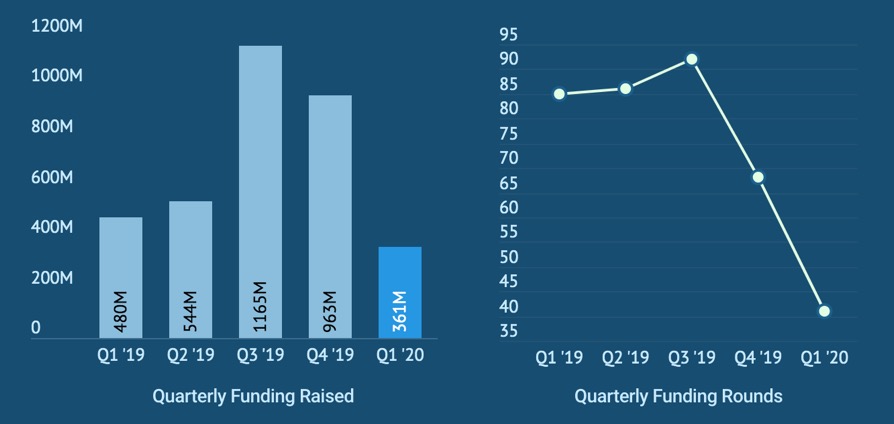

Toronto’s tech sector saw $361 million in venture funding over 41 deals in the first quarter of 2020, according to a new ecosystem report by Hockeystick.

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources.

“We may be cautiously pessimistic [and] a little bit worried, because we don’t expect it to pick up in Q2.”

The total venture funding for startups in the Greater Toronto Area (GTA) in Q1 represents a 25 percent drop from Q1 2019 and a 63 percent drop from the previous quarter. Max Folkins, data analyst and content writer at Hockeystick, told BetaKit the decline in funding in Q1 could be attributed to the lack of a “big deal” in the quarter.

In Q4 2019, the big deal in Toronto was 1Password’s $265 million CAD Series A round, and in Q3 2019, Clearbanc raised $393 million CAD in venture capital.

“The biggest deal in Q1 2020 in the GTA was topped out at $72 million, whereas every quarter in 2019 had a deal over $100 million, and some had multiple,” Folkins said. The analyst also noted that he does not expect funding to rebound in the near future, given the anticipated impact of the COVID-19 pandemic on the Toronto tech ecosystem.

What Hockeystick’s report found perhaps “more worrisome” than the decline in funding is the precipitous drop in deal volume in Q1. The 41 funding rounds represent a 41 percent decline year-over-year, less than half the number in Q3 and Q4, and 25 percent lower than Q1, 2019’s lowest quarter. The deal volume in Q1 is the lowest it has been since at least Q3 2018, when Hockeystick began collecting such data.

RELATED: Montréal tech saw five-quarter high in venture deals prior to COVID-19 crisis

The most active investors in Q1 2020 included the Business Development Bank of Canada, iGan, MaRS, Inovia Capital, and Real Ventures. Fifty-four percent of active investors in Q1 were Canadian, which Raymond Luk, CEO of Hockeystick, said is typically closer to approximately 70 percent. Luk noted that many of these new foreign investors have been from the United States, looking to deploy capital into later-stage deals.

“If Canadian funding has gone from 70 percent domestic to 50 percent, that’s quite a big shift, [but] it’s not all bad news,” Luk said. “It’s maybe bad for local VCs having competition, but it’s certainly good for entrepreneurs.”

AI and EdTech dominate in funding

Toronto-based startups in the EdTech and artificial intelligence (AI) verticals received 46 percent of all venture funding in the first quarter of 2020, which Folkins said was out of the ordinary for a region where FinTech and life sciences tend to lead in funding.

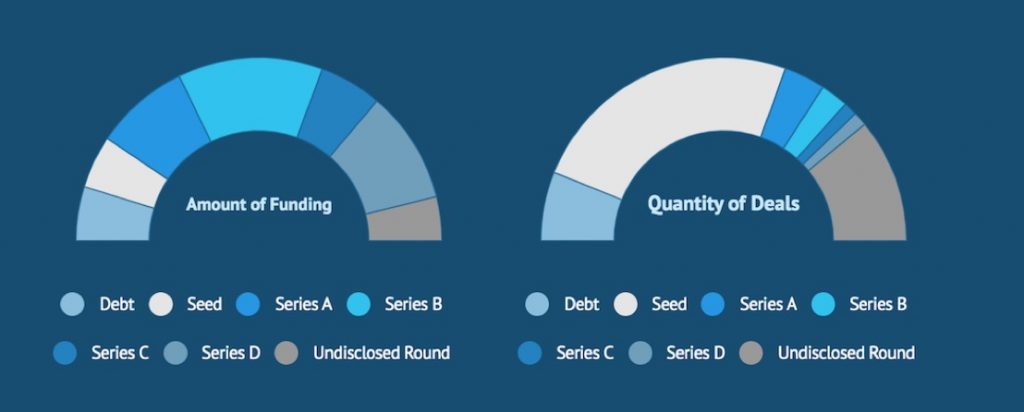

Although seed-stage deals received nine percent of funding, this stage led in deal volume.

The AI vertical led in total funding in Q1 2020, raising a total of $92.82 million in Q1, with the largest rounds including Ada Support’s $63.7 million CAD Series B round and BenchSci’s $29 million CAD Series B round. EdTech came in second, with TopHat’s $72 million CAD Series D round.

Aside from the EdTech and AI outliers, deal volume was down for all verticals. Biotech funding totalled $42 million in Q1, representing a 42 percent decrease from Q4 2019. FinTech funding totalled $43.8 million, down by 27 percent from the previous quarter, and 64 percent year-over-year. Folkins noted that he expected FinTech venture funding to be much higher in Q1 2020.

“We’re used to seeing quite a bit of funding in FinTech and in life sciences,” Folkins said. “Of 2019, the average [in FinTech funding] is around $200 million, usually led by pretty big deals, which could also be a part of why it is down, because there were no huge FinTech deals.”

Early-stage funding falls

Only $33 million went into early-stage startups in the first quarter of 2020. Later stage rounds comprised 75 percent of funding in Q1. Series A rounds with $60.6 million going into Series A rounds, $92.7 million into Series B rounds, $40 million into Series C rounds, and $72 million into Series D rounds.

Luk said it is typical for the majority of dollars to go to late-stage deals, but the shift away from seed-stage deals may indicate tough times ahead for seed startups.

“A potential concern for [Toronto] is a flight to later-stage and the impact that might have, not on the next quarter or maybe even a quarter after, but next year, when there are fewer companies that we’ve been able to nurture beyond the seed stage,” Luk said. “If that happens next year, there will be fewer late-stage deals.”

Although seed-stage deals received only about nine percent of funding, this stage continued to lead in deal volume, representing 48 percent of all deals in the quarter.

‘Cautiously pessimistic’ about Q2

During the weeks of mid-March, when COVID-19 restrictions first began to take effect, there was no slowdown in weekly deal volume. Luk noted, however, the pandemic is expected to negatively impact deal volume and funding in the following quarter.

“It’s unfortunate that [Toronto] didn’t have a better quarter before COVID-19 hit,” Luk said. “We may be cautiously pessimistic [and] a little bit worried, because we don’t expect it to pick up in Q2.”

Notably, although Q1 2020 represented one of the lowest-performing quarters since 2018, tech companies in the Toronto region still raised more funding and closed more deals than Montreal companies did in one of the city’s highest-performing quarters. Funding for Montreal companies in the first quarter of 2020 was over four times higher than funding in the same quarter last year, and the 37 deals Montreal companies closed in that quarter were also the highest volume over the last five quarters. This difference indicates a large disparity in scale between the two ecosystems.

An infographic featuring Hockeystick’s preliminary findings for the quarter can be found here. Those interested in receiving the full forthcoming GTA Technology Report can sign up here.

BetaKit is a Hockeystick Tech Report media partner.