Nuula is a newly branded FinTech company, now headquartered in Toronto, that is looking to provide small businesses with data and a new way to access loans and financial services.

The company was formerly known as BFS Capital, which operated for 20 years offering small business loans. Based out of the United States, BFS Capital began its transformation to a company with a real-time data and analytics app in 2019, when it opened a Toronto engineering hub.

Now, Nuula has secured $120 million USD in a mix of credit facility and equity financing to support its shift from a company solely focused on loans to “re-imagining” how small businesses access capital and business metrics after the pandemic.

“Innovations in financial technology have largely democratized who can become the next big player in small business finance.”

The company announced the shift from BFS Capital to Nuula in April. Over this year, it launched an app offering real-time data and analytics for business metrics that will fuel a new line of credit product as well as a financial partner services ecosystem.

The financing to support its launch includes $20 million in equity led by FinTech investor Edison Partners (Nuula declined to disclose the other investors in the round) and a $100 million credit facility from funds managed by the Credit Group of Ares Management Corporation, the latter for Nuula’s loan offering.

In a recent interview, Nuula CEO Mark Ruddock explained that his company’s goal is to create an app where small businesses can access a range of financial information and services digitally and all in one place.

Nuula is trying to take away the “complexity” small businesses have in accessing various loans, insurance, and other financial services from a variety of sources. Nuula, he argued, gives businesses the fundamentals of how their business is doing “at a glance … and then share that data with them so that we can unlock credit for them, perhaps earlier than they would get it from any other provider.”

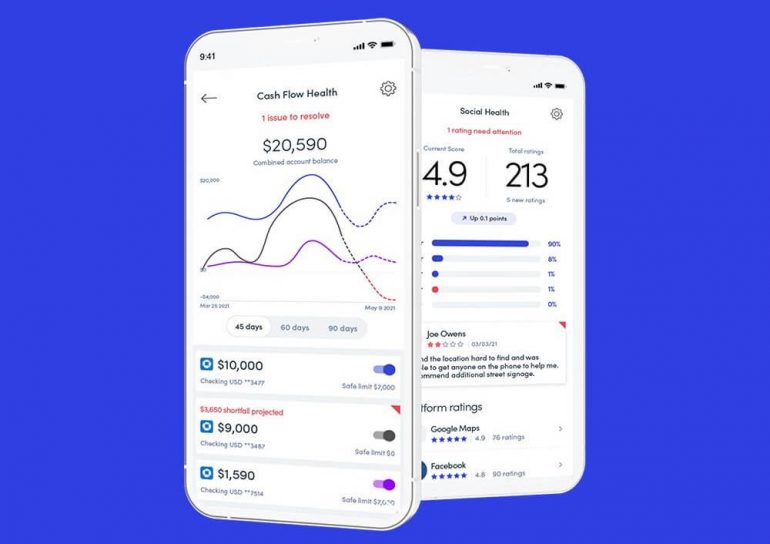

Nuula’s approach to financial services for small businesses is three-pronged. The company’s app allows businesses to view and analyze a number of business metrics, from forecasting cash flow to monitoring credit, social ratings, and more.

RLEATED: OKR Financial launches $150 million fund to help early-stage startups access funding, loans, grants

That cache of data will also be the cornerstone of Nuula’s line of credit product, set to launch later this year, and how Nuula underwriters small businesses.

Ruddock argues that the COVID-19 pandemic “turned [underwriting] upside down.” With many small businesses struggling to stay afloat, typical six month assessments about company financial health are harder to assess. Given these struggles over the past year and a half, “you’re going to see formerly great businesses look like poor businesses,” Ruddock argued.

Nuula’s CEO wants to combat this by using his company’s real-time data to assess companies for loans rather than focus on what could be marred, recent finances. Ruddock said this also allows Nuula to offer what he called “cash in the cloud” loans where businesses are not charged unless they use a portion of the funds, in which case they are charged $1 a day per $1,000 borrowed.

The data also supports a broader partner ecosystem through which Nuula hopes to offer a number of financial services to its customers. Nuula is still building out the partner ecosystem with the hopes of offering various types of credit for businesses and making available other financial services such as insurance. In fact, the type of loans Nuula previously offered as BFS Capital have been moved over to a partner company that Ruddock said is set to join Nuula’s partner ecosystem this year.

The CEO argues Nuula’s use of real-time data presents an appealing opportunity for partners that allows them to assess small businesses on an ongoing basis.

“Innovations in financial technology have largely democratized who can become the next big player in small business finance,” said Gary Golding, general partner at Edison Partners. “By combining critical financial performance tools and insights into a single interface, Nuula represents a new class of financial services technology for small business, and we are excited by the potential of the firm.”

Nuula’s app is currently available in the US, with the line of credit set to become available later this year. The company expects to bring on more financial partners and launch in Canada within the year. Nuula also has plans to launch in the United Kingdom, where it operated as GFS Capital in the past.

Nuula is running its refreshed operations out of Toronto. Ruddock noted in the April blog post that the company “established a digital headquarters in Toronto” and has been working to hire data, machine learning, and other tech talent. Nuula currently has more than 50 staff based in Toronto with more than 100 globally.

The decision to transform Nuula and focus its operations out of Toronto was in the works when the company launched its office in the city in late 2019. Ruddock told BetaKit Nuula was attracted to Toronto because of its tech talent pool and low operating costs. In 2019, the company explicitly expressed its desire to leverage Toronto’s data science and machine learning talent in order to develop the “next generation” of financial products.

The company plans to continue building out its team and technology from Toronto and hopes to raise additional capital to fuel its go-to-market strategy in early 2022.

Image source Nuula via Twitter