District Ventures Capital has closed its first fund at $100 million CAD, after securing $35 million CAD in additional funding from business financing organization BDC Capital and agricultural lender Farm Credit Canada (FCC).

“District Ventures is well-positioned to support the wave of innovative Canadian startups we see operating in the food and health and wellness sectors.”

Previous investors in District Ventures’ fund include ATB Financial, OMERS, and BMO. The fund focuses on investing in early-stage companies operating in the food and beverage, health and wellness, and beauty consumer goods verticals.

The fund invests up to $7 million into consumer food and health goods. The fund has previously invested in companies like Montreal-based recipe and food delivery startup Cook it, as well as Premama, a prenatal vitamin developer.

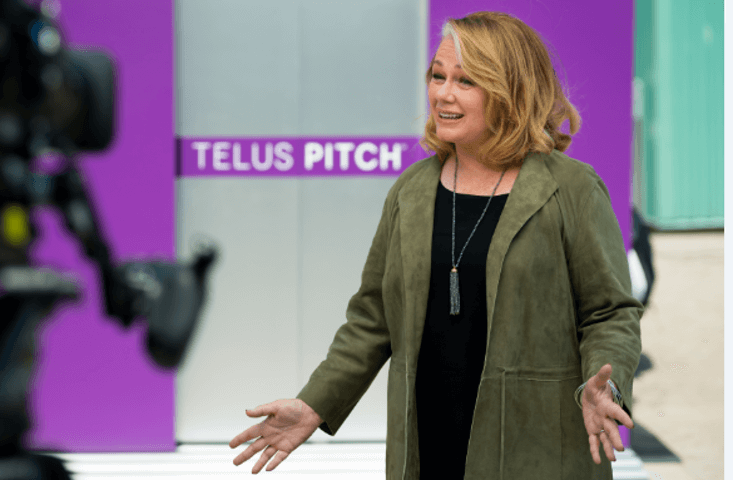

District Ventures was founded by general partner Arlene Dickinson, , an investor and dragon on CBC’s Dragons’ Den. In addition to capital, District Ventures aims to provide marketing, programming, and commercialization support to its portfolio companies.

RELATED: Arlene Dickinson’s District Ventures accelerator announces sixth cohort

Operating as the country’s largest agricultural term lender, Rebbecca Clarke, FCC vice president and treasurer said District Ventures is playing an important role in ensuring access to capital and other support services for companies that are innovating and expanding Canada’s food industry.

“District Ventures is well-positioned to support the wave of innovative Canadian startups we see operating in the food and health and wellness sectors,” said Alison Nankivell, vice president of fund investments at BDC Capital. “This is a significant area of competitive strength for Canada which BDC Capital wants to develop by working with partners such as District Ventures.”

District Ventures also operates an accelerator, investing $150,000 in startups entering its semi-annual cohort in exchange for a minor equity stake. Startups undergo a five-month business acceleration program focused on increasing sales, distribution, and brand equity. The firm also operates a marketing agency for startups.