Welcome to a BetaKit weekly series designed to help startups and entrepreneurs. Each week, investors tackle the tough questions facing founders today. Have a question you would like answered? Tweet them with the #askaninvestor hashtag, or email them here.

In 2016, our predecessors gave feedback on one of the most important parts of the fundraising process, breaking down CareGuide’s seed deck and sharing an investor’s perspective on the good, the bad and the omitted.

This week, Christian and I are bringing back the tradition with a submitted pitch deck from Toronto startup Finaeo that they used to raise $2.25M in June 2017 from Impression Ventures, among others. At the time of this raise, the company was in beta testing, with an MVP of their CRM platform for financial advisors. Raising a seed round before you have demonstrated product-market fit can be a challenge; various elements of this dynamic have surfaced across our weekly columns over the past few months.

So how did they do on my criteria?

Founder-market fit

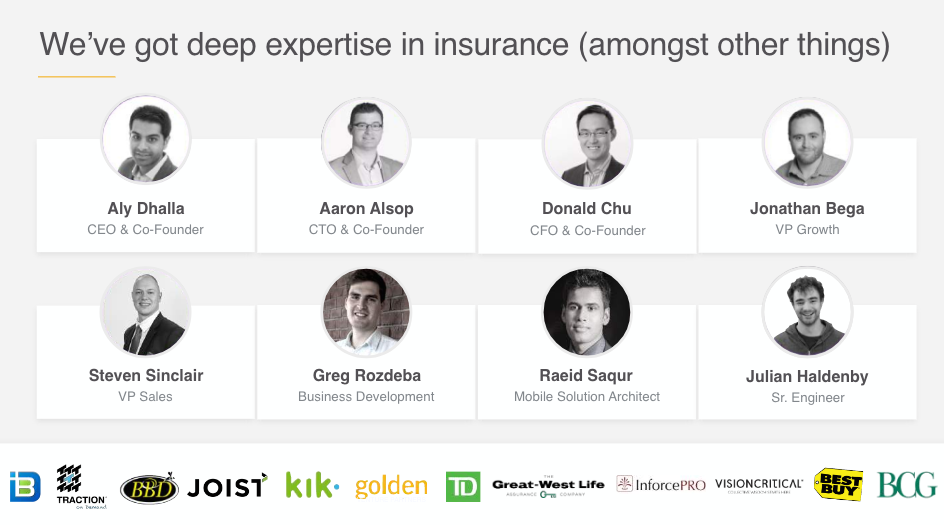

Like many readers of this post, founder Aly Dhalla was an unknown founder to local VCs. He had only just moved to Toronto and most of his network was back on the west coast. How to overcome this anonymity and gain credibility quickly? First, he was hyper-targeted with who he was pitching. Impression is a seed-stage FinTech-focused fund, iGan is a seed-stage B2B SaaS fund, and 500 Startups is a seed-stage fund with a reputation as a known backer of early-stage companies with a great vision, but nothing else. Staying targeted on the pool of VCs increased the chances that he was speaking to VCs who could compare his business model to countless other similar pitches, as well as increasing the chances that someone he was talking to had identified this gap in the market already and was actively searching for a founder with a solution.

Finaeo’s deck does a great job highlighting the team members’ relevant experiences and pedigree. Within the core founding team, they cover startup experience (Kik, Vision Critical, Joist), VC experience (demonstrating an eye for scalable growth) and just good pedigree (BCG).

Product-market fit

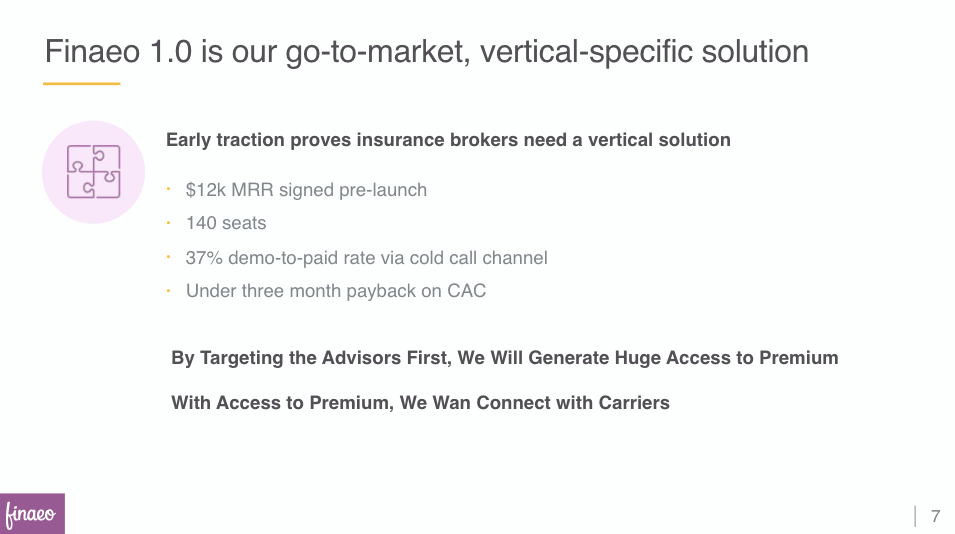

In the absence of meaningful customer adoption, VCs are looking for proxies that are indicative of future adoption. Showing concrete interest (not just “five customers said it’s a good idea that they would consider adoption”) in an MVP is a great way to do this.

Aly showed the metrics that he did have — MRR, number of seats, demo-to-paid ratio, customer acquisition cost — which demonstrated early interest in the product. Possibly, and more importantly, it also showed that the founding team understood what KPIs they should be tracking. This demonstrates both early success and maturity of thought.

Valuable problem

This section jumps around across the deck, so it takes a bit of work on the VC’s end to build a coherent narrative out of the disparate slides. I’ve always preferred to see the problem, the necessary solution, and the overall market flow into each other, as we think of those components as building out the case for this being a valuable problem, not just a hard one.

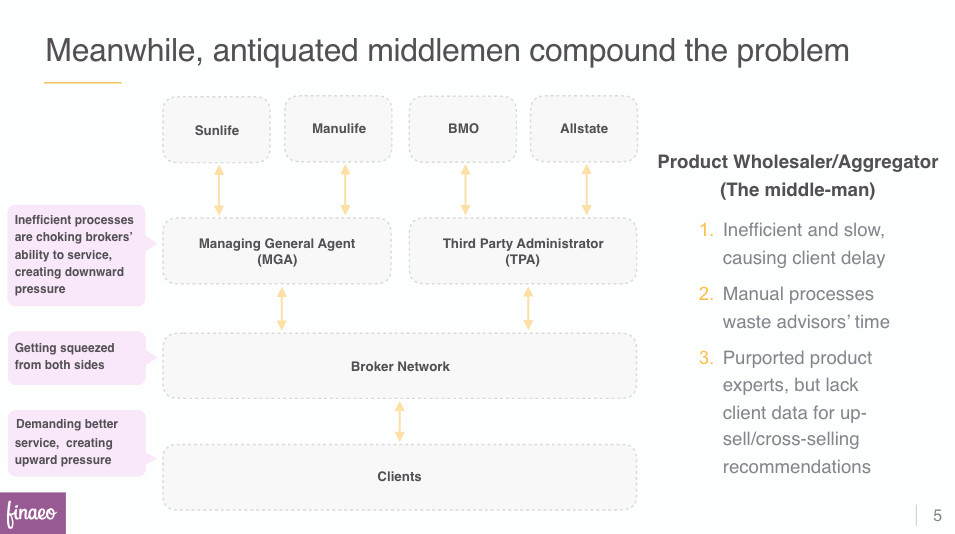

Regardless, the $220 billion number validates that this is a huge market, and crucially, Aly picked the right number to show. Finaeo is ultimately replacing middlemen, and thus the revenue earned by middlemen is the total available market (TAM) available for them to capture. Founders will often show an artificially large number — think the total spending on insurance products, or the value of insured items in North America. These numbers are big, but they’re also meaningless, and putting them into the deck is a negative signal that Aly avoids.

The other change I would make to this section is to flesh out a breakdown of the market size to contextualize the big number. How does that dollar value split between different segments (in Finaeo’s case, MGA vs TPA*) and across difference geographies? This is especially important in a regulated industry, so I understand what revenue growth realistically looks like as you clear regulatory hurdles.

Within the problem slide, Aly also explains why now is the right time for the company. Market timing is a big consideration for investors, and this slide smartly gets ahead of any questions about why this hasn’t already been built and what’s new that enables the opportunity.

*Note – you might be unfamiliar with these acronyms, which I discuss below.

What else?

The aforementioned three points are the main lenses through which I view an investment. However, there are four other points that jump out to me about this deck.

Explain your acronyms

Insurance is a complicated market — how does an insurance advisor differ from a broker? What differentiates MGAs from TPAs? When your industry has a lot of jargon, define that jargon for VCs unless you know they’re well-versed in the space. If the VC has another portfolio company in that same industry or has been actively writing/speaking on your market opportunity, they likely know your jargon, but don’t assume they will otherwise.

Make the grand vision crystal clear

The Finaeo 2.0 strategy is what enables the massive market opportunity, but this slide itself takes some time to grasp. This visualization sets the company up for questions around how 1.0 co-exists with 2.0, and the ultimate impact on MGAs and TPAs is unclear.

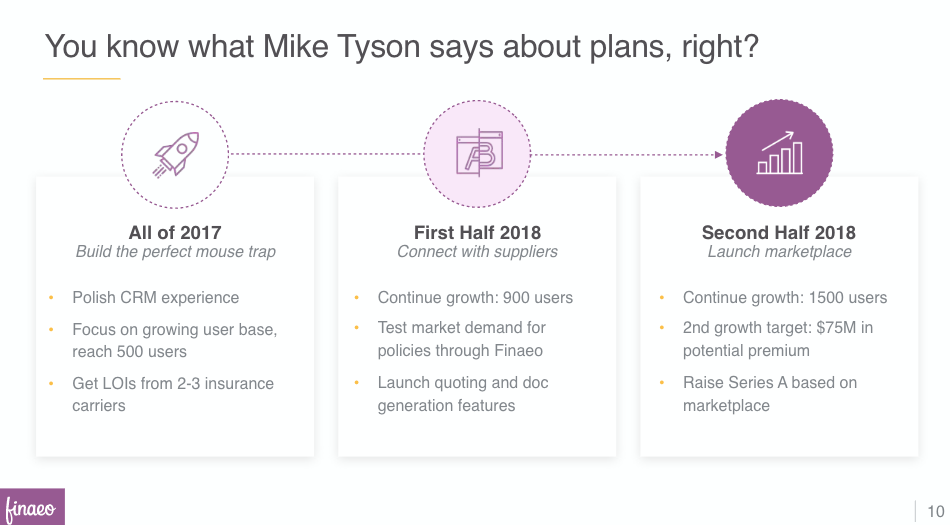

Execution

This slide shows understanding of how to get from Finaeo 1.0 to Finaeo 2.0, but it’s light on detail about go-to-market strategy and distribution channels. It’s great that you’re tracking from 500 users to 1,500, but I want to know how you’re acquiring them – through insurance partners? Professional associations? LinkedIn cold emails? SEO?

Christian’s take:

I was introduced to Aly by a mutual friend, David, from the investment business in late 2016. Aly’s name came up over coffee as we were actively looking for founders and companies disrupting the advisor space. We were also actively looking for companies disrupting various parts of the insurance business. When David mentioned he knew of a founder building a solution to help advisors disrupt the insurance business, I was intrigued and asked for an intro.

It was late in the year, so we didn’t end up meeting Aly until mid-January. In advance of the meeting, Aly sent me the above deck so I could come prepared for our meeting, something I strongly advise all founders do. The two slides that caught my attention immediately was “how it’s done today” and the “Finaeo 2.0” slide. Aly and I spent a good portion of our first meeting discussing Finaeo’s plans to place itself at the hub of the Life Insurance business.

It may be without the Finaeo 2.0 slide in the deck we would never have spent time discussing the ‘marketplace’ idea and focused instead on the CRM platform, which would likely have not resulted in an investment from Impression. I used marketplace in asterisk because while there are marketplace like characteristics, it isn’t an entirely accurate description given the market dynamics of how insurance policies are sold and administered. To this day, I’m not sure Finaeo 1.0 and 2.0 are super clear, but we’ve ended up adopting it as internal jargon.

Finaeo is now well into it’s “2.0” execution and I’m happy to report I’m a proud and happy investor!

Got a question for the investors? Email them here.