The Accelerator Series is a multi-part spotlight on Canada’s startup accelerators and the people who lead them.

Canada’s Leading Accelerator FounderFuel Does Things in Unorthodox Ways- And It Has Achieved Unorthodox Results

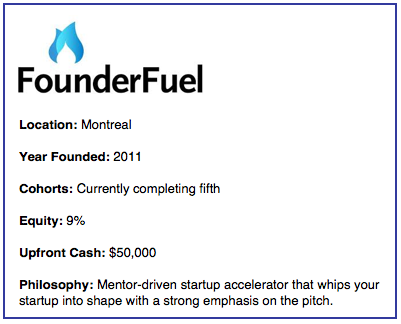

Montreal’s FounderFuel accelerator program has made investments into 46 startups since launching in the fall of 2011, the most of any other Canadian accelerator. Quantity can never imply quality, but in this case it might. Several leaders of competing accelerators in Canada have told us throughout The Accelerator Series that the Montreal program is the one they look up to.

So besides being one of the oldest programs in Canada with one of the best track-records, what makes this environment different?

General manager Ian Jeffrey was unorthodox in our interview, offering much that went against the typical startup-jargon-grain. Particularly he was blunt about how many companies that come through the program will turn out to be failures, a subject that most people in his position generally won’t touch.

He was strongly opinionated about what the program will offer startup entrepreneurs, and what it won’t. “We are much more explicit with the companies about how difficult its going to be, how historical venture capital data says only 20 percent of companies will succeed,” Jeffrey told BetaKit. “The default status of these companies is failure and making the companies understand that from the start is extremely important. We’re okay with some of these companies failing, it’s part of the model.”

What clearly irks him is companies coming into the program expecting that they’re owed something. Not so fast, said Jeffrey. Many companies seem to think they’re doing the program a favour by participating, but Jeffrey said all they’ve accomplished has proven that they have potential. From then on its “forming an alliance with these people and agreeing to build this thing together.”

Along those lines, he said that quite often he’s selling entrepreneurs on the program when they have 500 Startups, Y Combinator or TechStars knocking on their door too. In these cases Jeffrey said its actually more important that there’s a good fit, rather than “winning” the sales pitch.

“We’ll sell the program and at one point I just stop because we want the company to want in. If we twist somebody’s arm too much and they come in, it sort of starts on the wrong foot. You want people who want to be with us because that sets the tone properly for the 12 weeks.”

Now in its fifth cohort, FounderFuel’s fresh group of startups, eight in total, are four weeks into their 12-week journey. They all get $50,000 upfront cash for nine percent equity, as well as several other perks like the $150,000 convertible note from BDC and a second DemoDay in Silicon Valley.

He wouldn’t tell us much about the new cohort other than that two companies are in the connected device space (one of which you all have read about several times on Canadian tech blogs), four are from Montreal and the rest are from Toronto, Vancouver and Ottawa.

Every cohort has seen companies change their name and every cohort has seen at least one cofounder get fired. He said about half of every cohort ends up raising “significant” funds after the program, typically between $600,000 and $1.5 million, a “very good batting average” according to the general manager. But he also admitted it’s still too early to tell how many will do well long-term.

Of course, this is what FounderFuel and its parent venture capital firm Real Ventures wants. This is what every accelerator wants: returns from a few of the many companies that it places small bets in.

However, several accelerator heads across the country agree that it’s not clear if this model is highly sustainable in the long term, particularly for accelerators who lean on groups of several different VC firms for their equity bets. Equity is already split up among those firms, and (if and when) a company makes a return those stakes are often diluted even more.

But FounderFuel has always rested on a solid foundation that places all the bets: Real Ventures. It means sustainability is (a little) easier in the long run. “The problem is that most of the accelerators out there are trying to generate a return with all the companies they fund, which going back to historical data, is impossible,” he said. “So the people are are running programs who think they’re going to launch five great companies or 10 great companies a year are blinded. I think they’re fighting a battle that’s impossible to win.”

The program has produced several companies the went on to be “successful,” whether that means raising significant funding or consistently showing healthy and improving metrics. Jeffrey looks at Playerize as the cream of the 46-company crop, a Vancouver and San Francisco-based company from FounderFuel’s first cohort that specializes in monetization and high quality user acquisition for the social and mobile gaming industry. “I’d venture to say that Playerize is the best accelerator graduate out of any accelerator in Canada,” he said.

He also referenced Ooomf, the Montreal-based startup that came into the program’s second cohort in early 2012 with a few ideas and no business. But the program made a bet in founder Mikael Cho, who ended up pivoting his company’s vision several times. Now its an invite-only marketplace where handpicked, talented mobile & web creators connect with and work on projects they love. It’s also done quite well since.

Finally, Jeffrey also name-dropped OpenCare, a booking engine that helps health providers acquire patients across the web, which recently raised $1.3 million in funding.

Going forward FounderFuel see’s its big challenge in helping its companies raise seed rounds of funding quicker. For Jeffrey it will mean creating more opportunities for the companies to get in front of investors, so that by the time DemoDay rolls around the cheque-writers are more than familiar with whoever is pitching on-stage. Currently companies are taking six to 18 months before they raise money. Maybe a larger US presence (including the program’s San Francisco DemoDay) will improve that.

The structure of the program is based on careful planning and diligence, and Jeffrey says it’s probably “the most structured program out there.” Ultimately he wants it to aid companies and provide them with the tools to be better and faster. Part of that is placing a heavy emphasis on the pitch, what Jeffrey refers to as “the new business model”.

“Building a pitch the way we build a pitch is extremely difficult. It’s about crafting something where everything you say is for a reason, because when you’re pitching you’re taking the minds of the investor from one place to another,” he said.

He might seem over-confident but the truth is, Jeffrey expects more out of himself too. He said his report card shows a 7/10 for the guy who’s overseen all five cohorts. “Better than passing, doing good, but so many opportunities to do better.”

Have you checked out the rest of the series?

Part One: Hyperdrive (published January 13)

Part Two: GrowLab (January 20)

Part Three: UTEST (January 27)

Part Four: Extreme Startups (February 3)

Part Five: INcubes (February 10)

Part Six: The Next 36 (February 17)