The National Angel Capital Organization (NACO) released its 2015 report on support for early stage companies in Canada, taking into account the perspectives of tech players like VCs, angel investors, incubators, and accelerators. The report is based on 2014 data, and takes into account the perspective of 10 incubators, 17 accelerators, 24 angel groups, 8 venture capitalists, and 54 entrepreneurs across Canada.

“These findings have helped NACO to set a baseline for this important data moving forward. It provides the sector with a great viewpoint on where there are service gaps that can be filled and where additional support for entrepreneurs can be backfilled,” said NACO CEO and executive director Yuri Navarro.

The report found that 30 angel groups across Canada, representing 1,700 active angels, made 237 investments amounting to $90.5 million. The majority of Angels (63 percent) are located in Ontario, with 30 percent in Western Canada, and seven percent in Eastern Canada.

It also noted that VCs tend to focus on a small number of industries, with information technologies and life sciences getting the most attention. Of 2,160 applications in 2014, 11 were accepted for investment (less than one percent of applicants). VCs made an average investment of $1.7 million per deal.

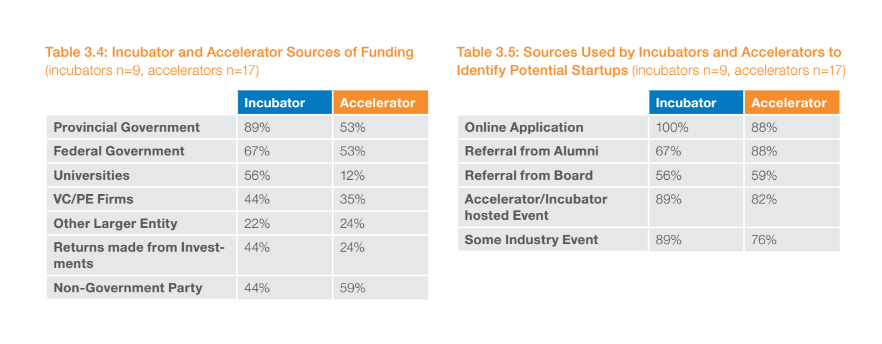

The report also looked at the function of incubators and accelerators in Canada, including their funding sources. It found that incubators accepted about 22 percent of applicants (299) in 2014, and accelerators accepted about 18 percent (410). When raising money, the first-round funding ask from an incubator participant was usually below $300,000, with most asks from accelerators being over $300,000, and several over $500,000.

The report was conducted in partnership with Dr. Kenneth A. Grant from the Department of Entrepreneurship and Strategy at the Ted Rogers School of Management at Ryerson University, and was supported by the Government of Canada, the Incubate Innovate Network of Canada, BDC, and KPMG Enterprise.

“The 2016 research is already underway and is drawing from a much bigger sample size allowing us to dig deeper into and provide more in-depth analysis for the sector,” said Dr. Grant Department of Entrepreneurship and Strategy at the Ted Rogers School of Management at Ryerson University.

Access the full report here.