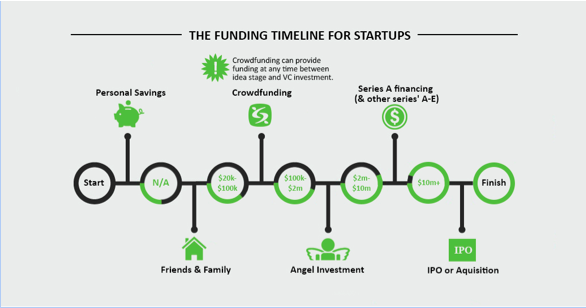

Typical tech start-up funding starts when all personal savings have been exhausted, and credit cards and lines of credit have been maxed out.

At this point, founders generally rally some friends and family support and gather enough money to keep the idea rolling. Startups have recently been using crowdfunding to build upon the friends and family stage, and magnify the raise. Once a business campaign is live, friends and family can of course contribute, but crowdfunding campaigns open to the public to raise more awareness of the business, and raise more funds for the startup.

After the friends and family stage, startups typically seek seed or angel investment. This is the beginning of giving away pieces of the business for financing, thus decreasing founder ownership in their own company. Angel funding amounts are commonly from $100,000 to $2,000,000 and represents a really important milestone for startups.

Recently, companies have also turned to crowdfunding to finance this stage, and actually bridge the gap between friends and family funding and venture capital funding, or in some cases bridge the gap right to acquisition.

While necessary for many startups, using angels and venture capital to grow a company dilutes founder equity. Rewards or pre-order crowdfunding is a non-dilutive way to help startups access critical capital earlier without giving up equity that will prove very expensive later. Any amount of time for company growth, while delaying giving up ownership, can translate into a larger portion of founder ownership down the road.

The great thing about crowdfunding is that it not only provides sufficient funds to keep the business afloat, it acts as a really important validation tool. As startups bootstrap, and operate with the lean start-up methodology, getting actual customer validation can be the most important part of early stage startup work. By getting a large group of the online community to contribute their own money in support of an idea, early stage validation is achieved.

My CEO and coworker at FundRazr, Daryl Hatton said that “it’s about building a community of people that are interested in your product or service or company.” Having a startup is all about rallying support and selling your idea. Pitching to the crowd can be a great place to start finding validation.”

In the same way, unsuccessful crowdfunding campaigns are not always a bad thing. Businesses that do not validate their value proposition with their customers early are in trouble. If startups can discover early that the appetite for their business offering is lacking, they might be able to save a lot of friends and family funding from being lost. Launching a campaign that gains no ground with ‘the crowd’ might be an indication that the business needs to pivot and adapt the value proposition.

Photo by crowdcapital.ca