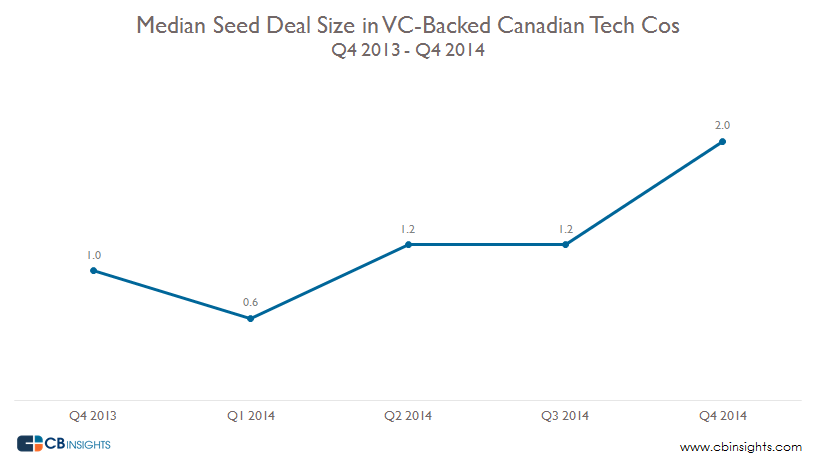

Venture capital analytics platform CB Insights has published a new blog post with a Canadian focus, this time tackling the state of Canadian seed funding. Analyzing Canadian venture funding deals in 2014, CB noted that median deal size reached $2 million in Q4 2014, more than double the median amount to start off the year.

While encouraging, the numbers don’t jive with the current narrative of Canadian funding, as many entrepreneurs have noted to BetaKit the difficulty in raising seed rounds. Perhaps Canadian VCs are holding their purse strings tight, preferring to commit more dollars to fewer deals.

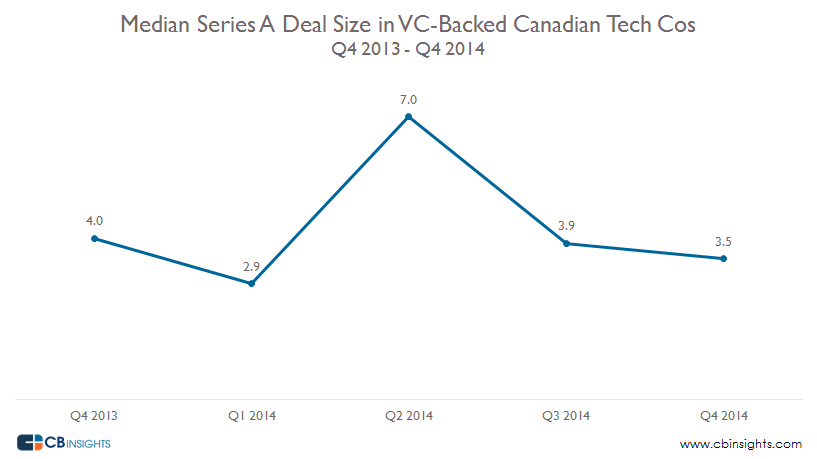

CB also stated that while seed deals have increased on average, Series A deals have decreased the past two quarters to sit at a median size of $3.5 million in Q4 2014. 2014 also saw a recent low in median deal size, as Q1 dropped below the $3 million line.