There’s a strange dance that startups weave when it comes time to think about exit strategy. If you actually approach buyers and say you’re for sale, often buyers wonder what’s wrong. Why does this company want to sell? Are their best days behind them? Do they have no ambition? Are they not able to raise money?

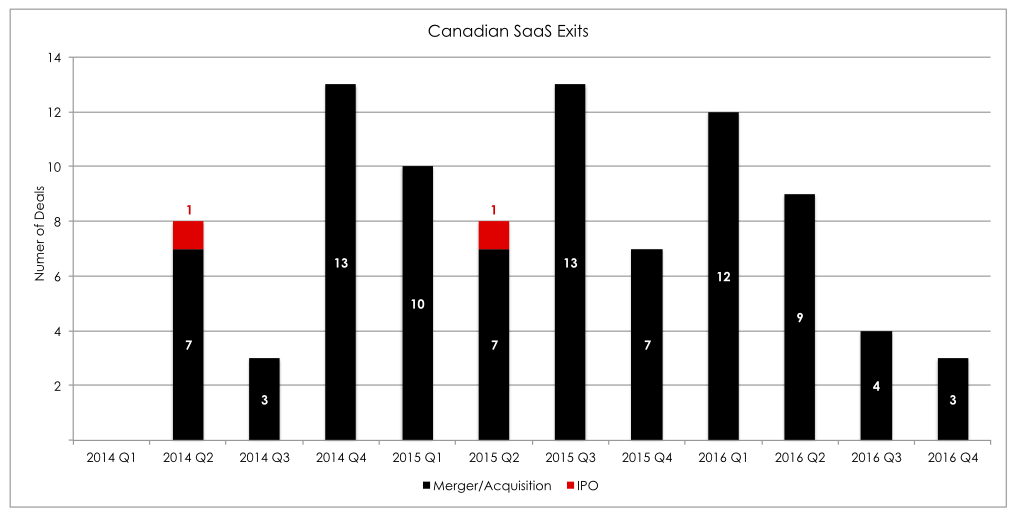

The reason this is strange is that over 90 percent of all exits happen via acquisition. If we look at Canadian SaaS exits in the last two years, all but two of them were acquisitions. There are more IPOs in the US, but on a relative basis, it’s still all about acquisitions.

So, what to do? How do you go about getting your company bought without actually “selling” it?

As I’ve posted before, the road to your exit marriage needs to begin long before your actual exit. I recommend that CEOs meet with the corporate development and product leaders of their most natural potential acquirers two to three times per year. You don’t go into these discussions with a ‘for sale’ sign. You’re just briefing them on what your business is up to. Once the relationship is established, use those contacts to help strengthen your partnership with those companies. This is more the case for B2B companies than B2C.

You significantly improve your chances of being bought if:

- You have been developing buyer relationships for some time.

- Buyers know your company, product, and team, and have had time to think about how you fit into their strategy.

- You have done all of this with multiple buyers at the same time so that if one shows some interest, you can quickly contact the others to let them know that there is inbound acquisition interest

Having buyers come inbound to you changes everything. There is a much higher likelihood of a deal closing at a higher value. Going outbound to them is more likely to result in a pass. And even if the buyer is interested, they will know that they have the leverage and will squeeze you on time and price.

The thing to remember is that no matter how great your company is, it will only be bought if what you have matches with what a buyer needs now. There’s a huge timing element to this. And the only way to get the timing right is to establish the relationships in advance. You will likely never know what your buyer’s roadmap is. So, they need to know about you so that they can connect the dots and come to you.

This post was syndicated with permission from Mark MacLeod’s Real Exits