Welcome to a new BetaKit weekly series designed to help startups and entrepreneurs. Each week, investors Roger Chabra and Katherine Hague tackle the tough questions facing founders today. Have a question you would like answered? Tweet them with the #askaninvestor hashtag, or email them here.

This week on Ask An Investor we answer a question on whether early-stage companies should look to strategic, or corporate investors for funding.

Traditionally, strategic investment has been much more popular for later-stage companies, typically those at the Series C or D stage. Today we are going to talk about whether strategic investment makes sense for Series A and earlier companies, what to consider in these rounds, and how to attract a strategic investor.

To break through and become a credible player, we felt it was necessary to achieve a services or distribution arrangement with a larger player.

I actually started my career in a VC group of a large corporate. Generally, I am more positive than ever about corporates participating in early-stage financing rounds. My experience is that corporate investors today act quite differently from 10 years ago. There are less strings attached to deals, and there are some very good, professional corporate groups out there who have learned to play nicely with entrepreneurs and more traditional VCs.

Corporates can be great endorsers for your company and can be a source of more patient capital than traditional VCs, who are at the mercy of where they are in their fund lifecycles. Of course, corporates can also provide value above and beyond what a VC can provide. Namely in the form of hands-on resources or distribution capabilities to scale your product to the audience you desire.

On the downside, getting an investment from a corporate doesn’t guarantee that you will get C-suite access. Corporates dedicate a very small amount of their available cash to VC activities. Taking $5 million from a $50 billion company is not material. This is just simple math. Furthermore, taking money from one corporate may discourage other similar companies from working with you. This is a fine balancing act and should be a real consideration for early-stage entrepreneurs.

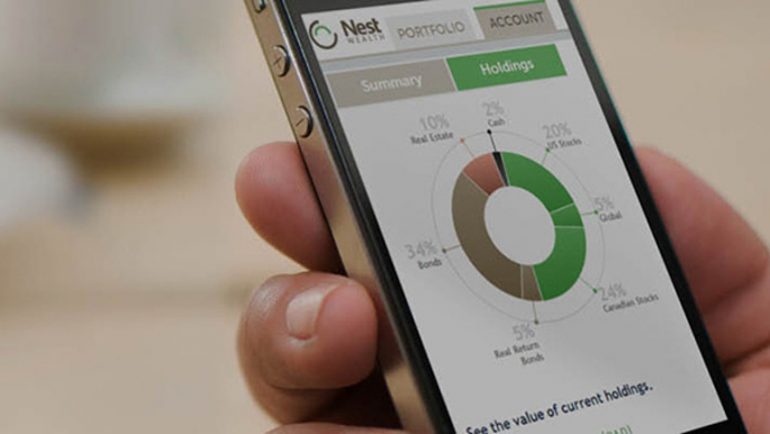

As we have done on occasion in the past on this column, today we feature a guest contributor. Randy Cass is the founder and CEO of Nest Wealth, a Toronto-based robo-advisor startup. Nest Wealth recently announced a $6 million investment as well as a significant services agreement from one of Canada’s leading financial institutions, National Bank. Randy is a well-known entrepreneur in the financial services space; he also previously founded and ran First Coverage, which was acquired by TIM Group in 2011.

Why is strategic investment a better option for early-stage companies than ever before?

Put simply, there are just more strategics interested in investing in startups than five or 10 years ago. Early-stage companies are approached more often by these investors now, and the deals have come a long way from the ‘my way or the highway’ type that used to exist. Corporates have realized that disruption is happening at a much more rapid pace, and that they need to get involved with interesting startups earlier. Corporates also now have greater expertise on innovation tactics, potential synergies to offer startups, and most importantly, enhanced distribution capabilities. All this amounts to a greater opportunity than ever for early-stage entrepreneurs to benefit from an agreement with the right strategic partner.

Why did Nest consider a strategic investor?

The financial services landscape in Canada is tight and constrained to about 10 large players. To break through and become a credible player, we felt it was necessary to achieve a services or distribution arrangement with a larger player. The cost of acquisition in direct-to-consumer services remains high, and a partnership with an entrenched player helps drive this down considerably.

An investment from a strategic provides an additional level of commitment beyond the services agreement.

Having a Big 6 bank investing in our company lends a lot of credibility to our company. Perhaps even more than a regular VC investing. It helps increase visibility in the Canadian market for sure, but we are thinking way bigger than just Canada. Having a name brand bank as a user of our product gives us a level of standing in conversations we have with banks around the world that we wouldn’t have without that stamp of confidence.

What should entrepreneurs take into account when considering a strategic investor?

First and foremost, it’s essential to find an investor whose thesis and desires line up with the vision of where you want to take your company. This comes down to letting them know where you are planning to take the company and reaching alignment with the people who are on the other side of the table.

It was very important for us to negotiate a deal that still allows us to control our own decisions and path – to do business without covenants or exclusions. Figure out what matters most to you and your team, and make sure your potential partner is okay with those values.

Also, I can’t overstate this enough: work hard to get a clean term sheet from your strategic investor wherever possible. They aren’t boxed in to the same extent as traditional VCs when it comes to what they can and can’t do in a term sheet. It’s encouraging to see the flexibility that some strategic partners will bring to the bargaining table.

As an early-stage company, how do you get the attention of a large corporate?

Some of this comes down to being in the right place at the right time. Of course, you need to have a good product that provides real value, and have a compelling partnership proposition for your potential corporate investor. It doesn’t hurt to be the “Lyft to someone else’s Uber.” Being just behind a competitor, even if the metric is just dollars raised, can garner you a lot of attention. You provide a credible alternative for strategic investors who may be feeling a lot of pressure and are thinking hard about making a move in your space now.

Can you get the value out of a straight partnership with a corporate without taking a dilutive investment?

It’s as important to have a services deal as it is to have an equity deal. Spend as much time negotiating your partnership agreement as you do your financing term sheet but make sure these are treated as two separate, distinct deals.

At Nest, perhaps we could have gotten just a services agreement or just an equity investment. However, the two combined were more powerful for us. An investment from a strategic provides an additional level of commitment beyond the services agreement. Your strategic is signing up for a long-term partnership with you. This can be quite advantageous. An equity investment in you could prevent them from partnering with a competitor of yours down the line. All that being said, if a strategic isn’t going to use or launch your product for a hard dollar cost, they probably are not the right equity partner for you.

Strategic investors are generally notorious for only participating in one round of financing, does this concern you?

I never plan the next round as I am doing a current round. I focus on optimizing value in the current round. I plan today to make the company successful based on what I know today. If we at Nest Wealth can execute on this plan, options in the future will be plentiful.

Got a question for the investors? Email them here.