PwC Canada and CB Insights have released the MoneyTree report on Canadian investment trends for the second half and full year of 2019 (all figures in USD).

“Increased competition for funding from global investors has created a healthy funding environment for Canadian startups.”

Last year saw Canadian venture capital (VC) funding rise to a record-setting $4.1 billion. Although Canadian funding experienced an 11 percent decline in deal count last year, the report tracked a 16 percent increase in year-over-year funding. Some massive rounds from last year were not included in this year’s report, including Verafin’s round, as the company did not disclose the debt and equity break out, and Sonder’s $210 million raise as the company is now headquartered in the United States.

A strong year for AI, FinTech, cybersecurity

Artificial intelligence companies saw increased investor attention in 2019, investment in Canadian AI companies more than doubled in the second half of 2019.

Last year’s funding to Canadian AI companies saw a 49 percent year-over-year increase in 2019 to $658 million with deal count reaching a new record at 57 deals.

This doubling of investment in the sector represented a 176 percent half-over-half increase compared to the same period in 2018. Although there was a jump in dollars invested, there was a slight decline in deal count, which the report said reflects the rise of larger deals in the sector. Element AI’s $200 million CAD Series B was among the top five largest VC rounds of the year.

“Deal share by stage to Canadian AI startups suggests the ecosystem is maturing, as a number of companies have progressed from seed- to early- to expansion-stage over the past few years,” the report noted.

FinTech companies also saw a striking rise in funding, as well as deal activity, raising $776 million in 2019, a 104 percent boost from 2018. Deal count in the FinTech sector rose to 59, up 11 percent year over year.

“There’s a strong link between well-funded FinTech companies and strategic channels [and] partnerships with the larger banks,” said Eugene Bomba, partner at the national technology sector at PwC Canada.

The cybersecurity sector also had a strong year, with $398 million deployed across 19 deals.

“Consistent with global trends, 2019 was a record year for cybersecurity funding in Canada alongside rising deal activity,” said Sajith Nair, partner at cybersecurity and privacy at PwC Canada. “From the protection of personal identity to critical company assets, funding to cybersecurity continues to rise as organizations and executives grasp the importance of preventative and detective measures in order to avoid a major crisis and build digital trust.

Investment activity in the Canadian digital health space declined marginally in 2019. Digital health companies, in particular, saw a reduction in both financing and deal count last year, with invested capital falling 26 percent year-over-year and deal count dropping 14 percent.

“The complexity of payer models and procurement cycles in digital health continues to be a challenge to growth and adoption in Canada,” said Cameron Burke, managing director of the technology sector at PwC Canada. “The fact that health and wellness made up over 50 percent of H2 2019 deals reflects that complexity and capital is going towards a simpler growth strategy.”

RELATED:Procurement could be Canada’s biggest barrier to commercializing healthtech innovation

Toronto stays on top, BC sees record funding

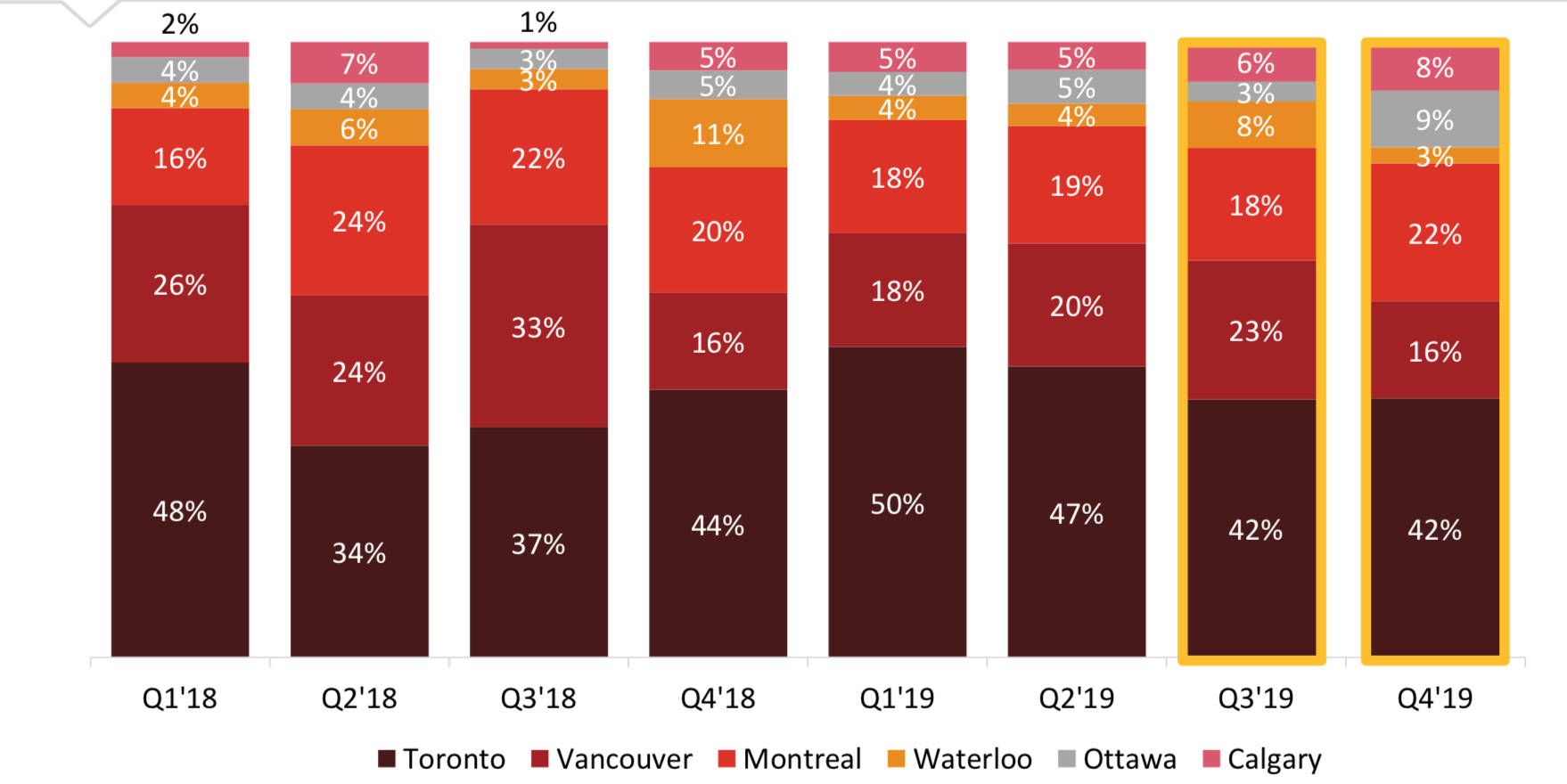

Toronto companies saw larger deals taking place as funding increased one percent in 2019 despite a three percent decline in deal activity. Companies based in Toronto continued to receive the most deals relative to other Canadian markets, although deals to the region saw a slight downtick in H2 2019, returning to levels seen in H2 2018.

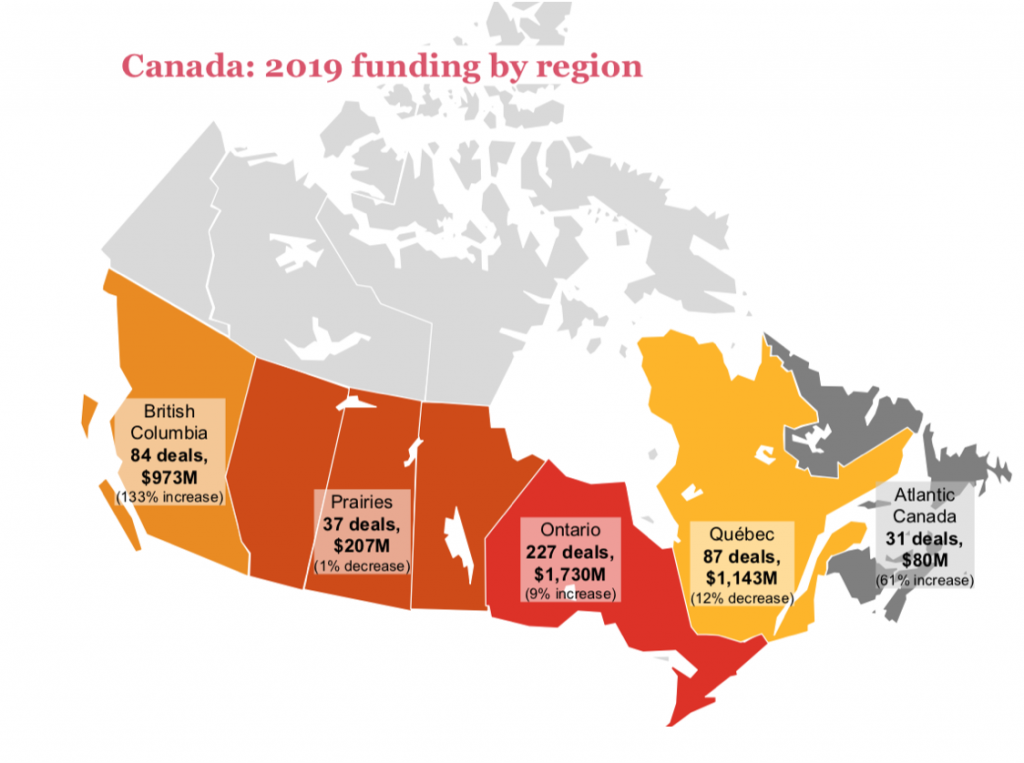

Although Toronto funding won out for the second year in a row, British Columbia also saw record funding in 2019. Driven by larger deals, the western province saw a 133 percent increase in total funding when compared to 2018.

Other notable markets included Vancouver, which saw a 134 percent increase from the year before, with $931 million raised over 72 deals. Last year’s Vancouver-based Clio raised a $330 million CAD Series D, meaning that round accounted for approximately 27 percent of the city’s funding, according to data provided by the MoneyTree report. In Calgary, 2019 deal activity increased from five to 22 deals, while funding rose to $132 million, a six percent increase compared to investment levels in 2018, Ottawa raised $119 million in 2019.

Seed and early-stage investments comprised the lion’s share of deals in H2 2019. The report stated that deal share by stage has remained relatively consistent over the past few quarters, with the majority of deals going to seed and early-stage companies.

RELATED: Narwhal List 2020 tracks a year of massive raises, 42 potential Canadian Unicorns

“Increased competition for funding from global investors has created a healthy funding environment for Canadian startups, with deal sizes and valuations trending higher,” said Shivalika Handa, corporate finance director PwC Canada. “While this is very positive, founders need to consider the long-term impact of lofty valuations on future funding rounds and exit opportunities.”

BetaKit is a PwC MoneyTree Canada media partner.

Image source PwC